Table of Contents Show

There may be products. Products are independently selected by our editors. We may earn an affiliate commission from the links with no charge to you, example: as Amazon Affiliate.

Disclaimer: We may earn an affiliate commission from the links with no charge to you.

We’ve hand-picked the most impactful financial literacy book for 2025, combining timeless wisdom with cutting-edge money management strategies. Our expert-vetted selection cater to every skill level, from beginners to advanced investors, and include digital resources to accelerate your learning. The book offers exceptional value through practical worksheets, online tools, and actionable steps for building lasting wealth. Let’s explore these transformative guides that’ll help you take control of your financial future.

Key Takeaways

- Expert-recommended books should match reader skill levels, from beginner concepts to advanced wealth-building strategies for 2025’s economic landscape.

- Modern financial literacy books must include digital resources and updated content addressing cryptocurrency, sustainable investing, and emerging markets.

- Top financial books should provide practical worksheets, calculators, and actionable steps for tracking progress toward wealth-building goals.

- Selected books need strong foundations in investment fundamentals while incorporating current market trends and technological innovations.

- Recommended titles must balance theoretical knowledge with real-world applications, including case studies and interactive learning components.

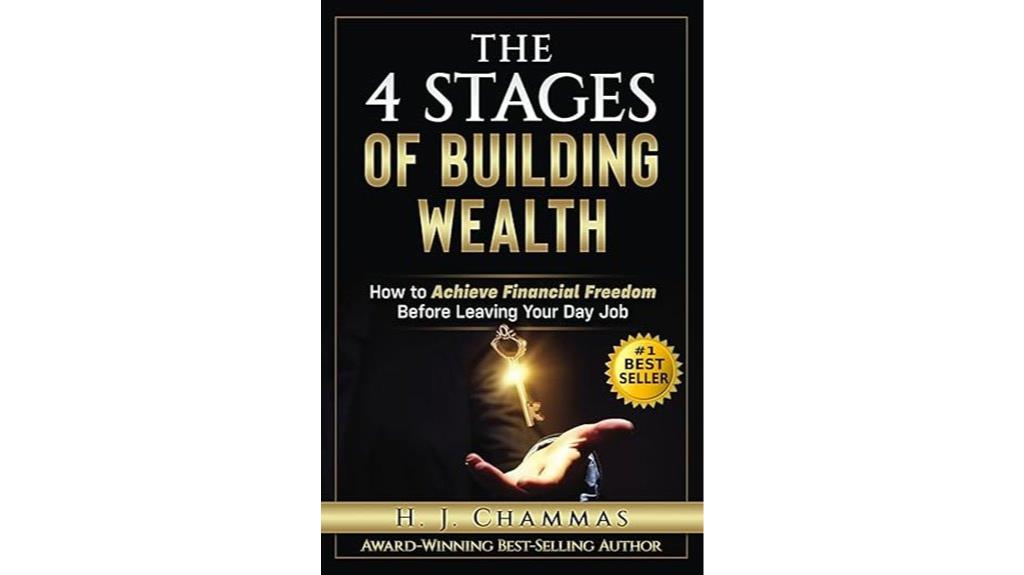

The 4 Stages of Building Wealth: A Guide to Financial Freedom

The 4 Stages of Building Wealth serves as an essential blueprint for novice investors looking to build financial independence before quitting their day jobs. We love how this guide balances informative content with practical strategies, making complex financial concepts accessible through helpful visuals.

While the book excels at explaining wealth-building principles and investment fundamentals, including real estate vs. stocks, we’ve noticed some technical issues with bonus resource access and editing quality. Despite these minor drawbacks, we’re confident this book delivers tremendous value, especially for young adults starting their financial journey. It’s particularly strong on teaching how unearned income should exceed fixed expenses – a vital concept for lasting wealth.

Best For: Beginning investors and young adults seeking foundational knowledge about building wealth while maintaining their regular employment.

Pros:

- Clear explanations of wealth-building principles with helpful visuals

- Practical strategies for achieving financial freedom

- Valuable bonus resources worth 20x the book’s cost

Cons:

- Technical issues with accessing bonus materials

- Poor editing quality with grammar issues

- Basic content may not satisfy experienced investors

Factors to Consider When Choosing the Financial Literacy Book to Master Your 2025 Budget

When we’re looking to build our financial knowledge through books, we need to evaluate each potential resource against key criteria like clear learning objectives and our current skill level. We’ll want to carefully weigh the cost versus value of each book while considering how its principles can be applied to our long-term financial goals. It’s also worth checking whether the books offer complementary digital resources, as these can enhance our learning experience and provide practical tools for budgeting in 2025 and beyond.

Clear Learning Objectives

Before diving into financial literacy books, establishing clear learning objectives will help you maximize your educational journey and achieve your 2025 budgeting goals. We recommend starting by identifying specific financial targets you want to reach, whether it’s creating a sustainable budget, building an emergency fund, or developing an investment strategy.

Let’s focus on matching your current financial knowledge with appropriate resources. We’ll want to pinpoint the essential concepts you need to master, such as cash flow management and risk assessment. Look for books that align with your comprehension level and provide practical, actionable steps. We suggest prioritizing resources with visual aids, chapter summaries, and hands-on exercises, as these elements will reinforce your learning and help you apply the concepts directly to your budgeting process.

Skill Level Matching

Matching your skill level to appropriate financial literacy books is essential for effective learning and avoiding frustration. We recommend evaluating your current financial knowledge honestly before selecting books that align with your expertise level, whether you’re a beginner, intermediate, or advanced learner.

If you’re new to finance, look for books with clear visuals and straightforward explanations that break down complex concepts. For intermediate readers, we suggest titles that offer practical strategies and detailed case studies to build upon your existing knowledge. Advanced learners should seek out books that present diverse perspectives and sophisticated analysis of financial principles.

We’ve found that choosing books with real-world examples matching your experience level helps you apply concepts more effectively and maintains your engagement throughout the learning process.

Cost Vs Value Assessment

Building on your understanding of skill levels, the next step involves weighing the cost against value when selecting financial literacy books for your 2025 budget planning. We recommend evaluating each book’s potential return on investment by gauging its actionable insights and practical strategies.

Look for titles that offer bonus resources like worksheets, online tools, or supplementary materials, as these can greatly multiply the book’s value beyond its purchase price. We’ve found that books presenting complex financial concepts in clear, structured formats often deliver better value by reducing your learning curve. Don’t forget to check reader reviews specifically mentioning value perception and real results. Most importantly, prioritize books that align with your current financial situation – a well-matched book addressing your specific needs will prove more valuable than generic financial advice.

Long-Term Application Potential

The enduring relevance of financial principles forms an essential criterion when selecting books for your 2025 budget planning journey. We recommend choosing books that teach strategies extending beyond current market trends, focusing instead on timeless wealth-building concepts.

We’ve found that the most valuable financial literacy books combine fundamental principles like budgeting and investing with insights on personal finance behavior. Look for content that addresses passive income creation and long-term wealth accumulation, as these concepts become increasingly relevant as your financial portfolio grows. Books should also guide you through different life stages, helping you adapt your money management approach as circumstances change. When evaluating potential reads, prioritize those that offer both practical tools and mindset shifts that’ll serve you well beyond 2025.

Digital Resource Availability

Modern financial literacy books should extend beyond their printed pages through robust digital resources that complement your learning journey. When we evaluate books, we’re looking for those that offer thorough digital tools like online courses, interactive worksheets, and supplementary materials that enhance our understanding.

We want to guarantee these digital resources are easily accessible across multiple devices, allowing us to learn wherever we go. Look for books featuring interactive elements such as quizzes and budgeting calculators that help us apply concepts in real-time. It’s also vital to verify that authors provide regular updates to their digital content, keeping pace with changing market conditions. Before committing, we should check user reviews to confirm the legitimacy and reliability of digital resource access.

Frequently Asked Questions

How Long Does It Typically Take to See Results From Financial Literacy Books?

We can start seeing initial results from financial literacy lessons within 1-3 months if we’re actively applying the concepts. Simple changes like budgeting and reducing unnecessary expenses show quick wins. However, major financial transformations, such as building substantial savings or investment returns, typically take 6-12 months or longer. The key is consistency and patience while implementing what we’ve learned.

Can Financial Literacy Books Help if I’m Already in Significant Debt?

While you might think it’s too late to learn when you’re deep in debt, that’s actually when financial literacy can be most powerful. We’ve seen countless people use book knowledge to dig themselves out of debt through better budgeting, strategic payoff plans, and avoiding costly mistakes. From understanding interest rates to negotiating with creditors, the right financial books can give us practical tools to tackle debt head-on.

Are Audiobook Versions as Effective as Reading Physical Financial Books?

We’ve found that both audiobooks and physical books can be equally effective for learning financial concepts, but it depends on your learning style. If you’re an auditory learner, audiobooks might help you better absorb complex financial information, especially during commutes or workouts. However, physical books offer advantages like easier note-taking, highlighting key concepts, and referring back to specific sections when needed. You can also combine both formats for enhanced learning.

Should I Read Multiple Financial Books Simultaneously or Focus on One?

Studies show that 92% of people retain information better when they focus on one topic at a time. We recommend focusing on one financial book before moving to another. When we juggle multiple books simultaneously, we often miss essential concepts and connections. It’s better to deeply understand one book’s principles, take notes, and practice its strategies before moving on to the next financial resource.

How Often Should I Revisit and Review Financial Literacy Books?

We recommend revisiting financial books every 6-12 months, as our understanding and circumstances evolve. After your first read, you’ll want to return to key concepts you didn’t fully grasp or areas that are now more relevant to your financial journey. We’ve found it’s helpful to keep notes or highlight important passages for quick reference during these review sessions. Don’t feel pressured to reread entire books; focus on sections that matter most.

Conclusion

We’ve explored how the right financial literacy books can transform our money management skills in 2025. While no single book holds all the answers, carefully selecting resources that match our skill level and goals is essential. By focusing on titles that offer clear learning objectives and long-term value, we’ll build a stronger foundation for wealth creation and financial freedom. Let’s take this knowledge and put it into action.